Prepaid Products

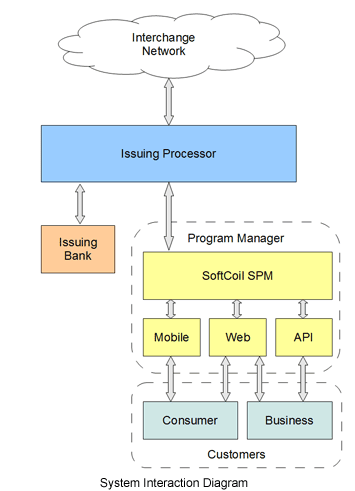

SoftCoil Program Management (SPM)

The SoftCoil Program Management suite (SPM) is a complete prepaid program management system supporting open network, private label and stored value systems in a single customizable system.

Architecture

Comprised of Core, Consumer and Admin modules; SPM segregates concerns while allowing secure and scalable access to services.

Core

The Core module handles all of the processing and management tasks associated with running a prepaid program in addition to providing a robust stored value engine that can be used standalone or in concert with other financial products. All system operations are processed by the Core, either directly or through secure API calls from other modules.

Consumer

The Consumer module presents a consumer oriented web-application to the users of your program that allows a full set of features normally associated with a traditional banking web-application. From customer acquisition to account management to a full set of available financial transactions, the Consumer module provides all the necessary features to service your customers.

In addition, it provides features to your business class customers like merchant services and payroll that are not normally available from a single provider.

Admin

The Admin module allows your staff dedicated, secure access to the operations and capabilities of your program. Access to functionality can be restricted to custom access groups like Customer Service, Fraud Management and Accounting or provided on an individual basis to your trusted employees. A full set of account management tools and reports is available to allow you complete control over your operation.

APIs

Though not technically a separate module, both the Consumer and Admin modules allow you to expose selected web-services to external or internal systems. Whether providing data to an internal business intelligence tool or allowing business customers API access to their account functionality, SPM provides the ability to deploy secure and reliable web-services as you see fit.

Features

Multiple Program Types

SPM was designed to support any program type you might want to opperate.

-

Open Network: Prepaid debit cards linked to a traditional open network like Visa or MasterCard are fully supported through SPM.

-

Private Label: A private label prepaid product allows a large merchant or merchant association to provide a secure payment vehicle to their customers and can serve as the foundation for a rewards program or other consumer service. It can be integrated directly into your merchant terminal system to allow fully internal payment processing to your business.

-

Stored Value: The stored value system operates as a prepaid product not associated with a physical card or external network and is often associated with a virtual currency based online marketplace.

-

Hybrid: A hybrid program allows you to mix and match open network, private label and stored value products as you see fit in your program. Most programs will eventually migrate to this approach as they add products to service additional customers.

Peer-to-Peer

A defining feature of the SPM system is the ability to provide customizable a peer-to-peer (P2P) financial transactions system for all of your customers. The can allow you to support anything from simple transfers between friends and family to complex payroll operations from the same platform.

Multi-Currency Platform

SPM was designed from the ground up to support multi-currency operations. Our multi-currency support allows you to choose to provide services to your customers in any number of currencies from a single local currency to as many worldwide currencies as you see fit. Accounts can be segregated to a single currency or allowed to operate in multi-currency mode supporting full foreign exchange operations on all transactions.

Virtual Currencies

In addition to support of traditional currencies, the private label and stored value program types allow you to define and operate in a virtual currency. (Points or Credits, etc.) You can define the internal exchange rates used to convert your virtual currency to another real world denomination for account loads, merchant purchases and withdrawals.

Merchant Payment Gateway

The SPM merchant payment gateway provides internal payment gateway services to merchants and consumers without involving an external payment network. This allows program managers to define their own fees policies to best server their market.

Fraud Control

Automated filters and business intelligence tools allow your fraud prevention team to quickly identify, block and recover funds from fraudulent account activity. Support for payment industry standard tools like Verified By Visa as well as proprietary account verification tools allow you to easily maintain target fraud rates for your program.

Mobile Access

SPM's API support allows for the integration of mobile access applications to the program. Traditional services offered to mobile users are account loads, transfers, withdrawals and statement data, but the flexible SPM API allows virtually any service to be offered in a mobile environment.

Regulatory Compliance

Whether industry government enforced regulatory compliance is one of the most costly facets of running a successful prepaid program. SPM provides tool to assist you out of the box and the ability to

-

PCI-DSS: SPM is capable of operating as part of a fully PCI-DSS level 1 compliant system.

-

KYC AML: SPM provides tools to support proper Know Your Customer and Anti-Money Laundering procedures.

-

OFAC: Integrated OFAC checks allow for the identification and flagging/clearing of potential specially designated nationals.